The global Crypto Tax Software market is witnessing rapid growth as governments and financial institutions increasingly require cryptocurrency users to comply with taxation regulations. Crypto tax software helps individuals and businesses accurately calculate, report, and file taxes on digital asset transactions, reducing errors and ensuring compliance with evolving tax laws. Rising cryptocurrency adoption, regulatory oversight, and the growing need for automation in financial reporting are driving market expansion globally.

Get Sample Report of Crypto Tax Software Market @ https://marketintelo.com/request-sample/88066

Market Overview

The crypto tax software market has gained significant traction over recent years due to the increasing volume of digital asset transactions and the complexity of crypto taxation. In 2025, the global market was valued at USD 1.1 billion and is projected to reach USD 2.45 billion by 2032, growing at a compound annual growth rate (CAGR) of 11.2% during the forecast period. Key drivers include the growing popularity of cryptocurrencies, rising awareness of tax compliance, and the adoption of automated financial management solutions by retail and institutional investors.

Get Sample Report of Crypto Tax Software Market @ https://marketintelo.com/request-sample/88066

Key Market Drivers

Rising Cryptocurrency Adoption

The rapid adoption of cryptocurrencies such as Bitcoin, Ethereum, and other altcoins is a primary driver for the crypto tax software market. As the number of crypto holders grows, so does the demand for tools that simplify tax reporting, ensure compliance, and reduce human error in complex transaction calculations. Businesses and individuals alike are turning to automated software to manage taxation obligations efficiently.

Regulatory Compliance and Oversight

Governments worldwide are implementing stricter regulations on cryptocurrency taxation to combat tax evasion and ensure transparency. Compliance requirements vary by country, necessitating advanced software solutions capable of handling multi-jurisdictional tax laws. Crypto tax software provides real-time tracking, transaction analysis, and reporting features, enabling users to meet regulatory obligations accurately and on time.

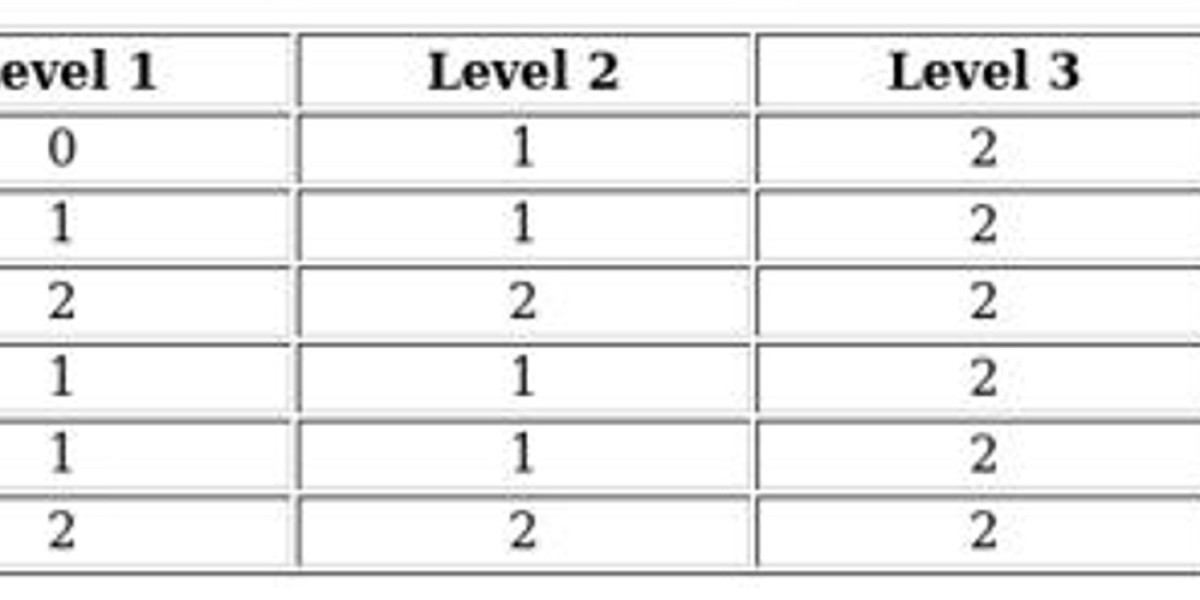

Market Segmentation

By Deployment Mode

Cloud-Based Solutions: Dominates the market due to flexibility, real-time updates, remote accessibility, and subscription-based pricing models.

On-Premises Solutions: Preferred by enterprises requiring full control over data, higher security, and integration with internal IT infrastructure.

By End-User

Individuals: Represent a growing segment, driven by retail investors and cryptocurrency traders seeking automated solutions for personal tax filings.

Enterprises: Includes crypto exchanges, financial institutions, and investment firms that require bulk reporting, audit support, and compliance automation.

By Geography

The global market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market due to high cryptocurrency adoption, regulatory enforcement, and advanced software infrastructure. Europe follows with strong fintech adoption and evolving crypto tax regulations in countries such as Germany, France, and the UK.

Asia-Pacific is expected to witness the fastest growth, fueled by increasing retail and institutional crypto investment, regulatory modernization, and fintech innovation in countries like Japan, South Korea, India, and Singapore. Latin America and the Middle East are emerging markets as crypto adoption and digital financial solutions expand in urbanized and high-net-worth regions.

Competitive Landscape

The crypto tax software market is moderately fragmented, with key players including CoinTracker, TaxBit, ZenLedger, Koinly, and TokenTax. Companies are focusing on enhancing platform capabilities, integrating AI-driven analytics, and expanding cloud-based solutions to meet diverse client requirements. Strategic partnerships with cryptocurrency exchanges, accounting firms, and fintech platforms are helping vendors expand their market reach.

Market Trends

Emerging trends include AI and machine learning integration for predictive tax analysis, support for multiple blockchain networks, and real-time transaction tracking. Platforms increasingly offer portfolio management, audit support, and automated filing features. Additionally, subscription-based pricing, multi-user access, and mobile application integration are enhancing user convenience and adoption rates.

Read Full Research Study: https://marketintelo.com/report/crypto-tax-software-market

Future Outlook

The crypto tax software market is poised for sustained growth through 2032, driven by increasing cryptocurrency adoption, evolving regulatory frameworks, and rising demand for automation in financial reporting. Integration with accounting software, blockchain analytics, and artificial intelligence is expected to create new opportunities for software providers. Retail investors, crypto exchanges, and enterprises are anticipated to increasingly rely on crypto tax solutions to ensure accuracy, reduce compliance risks, and streamline reporting processes.

Conclusion

The global crypto tax software market is set for significant expansion, supported by technological innovation, regulatory mandates, and the growing complexity of digital asset taxation. With applications spanning individuals, businesses, and financial institutions, crypto tax software is becoming an essential tool for ensuring compliance, accuracy, and efficiency in managing cryptocurrency taxes. Companies focusing on cloud-based solutions, multi-jurisdictional support, and AI-driven analytics are well-positioned to capitalize on this high-growth market.

About Marketintelo

MarketIntelo is a reliable market research and consulting firm providing data-driven insights and strategic intelligence to support informed business decisions. deliver high-quality market research reports, industry analysis, and forecasts across a wide range of sectors.

Our research is built on rigorous methodologies, reliable data sources, and expert analysis, ensuring accuracy and relevance. With a strong focus on client needs, MarketIntelo helps organizations identify opportunities, understand market dynamics, and achieve sustainable growth.

Website - https://marketintelo.com/

Linkedin Page - https://lnkd.in/d6cBE3ak

Related Report